带长影线的阳线

Understanding Long Shadows in Stock Trading

In stock trading, a long shadow, also known as a long wick or tail, refers to a significant price movement from the opening or closing price of a stock within a particular trading period, typically a day. These shadows can provide valuable insights into market sentiment and potential price reversals. Understanding the implications of long shadows is crucial for traders looking to make informed decisions in the stock market.

Interpreting Long Shadows

Long shadows can appear either above or below the body of a candlestick, representing the price range in which the stock traded during the given period. Here's how to interpret them:

1.

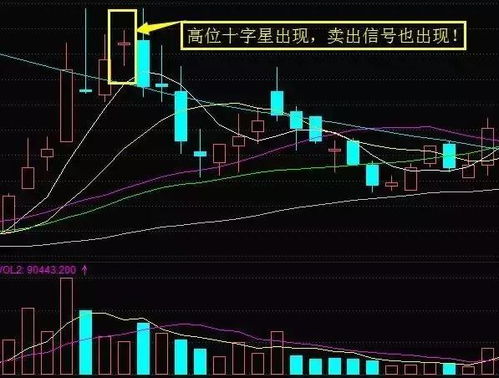

Upper Shadow:

An upper shadow occurs when the high price for the period is significantly higher than the opening or closing price. It indicates that there was significant selling pressure during the trading session, pushing the price up temporarily before it retreated. This could suggest that bears are gaining control, and there might be a potential reversal or downtrend.2.

Lower Shadow:

Conversely, a lower shadow forms when the low price for the period is significantly lower than the opening or closing price. It signifies that there was substantial buying pressure during the session, driving the price down temporarily before it bounced back. This might indicate that bulls are gaining momentum, potentially leading to a reversal or uptrend. Implications for Traders

For traders, long shadows can offer valuable insights into market dynamics and potential trading opportunities:

1.

Reversal Signals:

Long shadows often serve as reversal signals, indicating possible changes in the direction of the trend. For example, a long upper shadow following an extended uptrend could signal a potential trend reversal to the downside, and vice versa.2.

Support and Resistance Levels:

The length and direction of the shadows can help identify key support and resistance levels. Long lower shadows near a support level suggest that buyers are stepping in to push the price higher, indicating a potential bounce. Conversely, long upper shadows near a resistance level indicate selling pressure and a possible price rejection.3.

Confirmation with Volume:

Traders often look for confirmation from trading volume to validate the significance of long shadows. A long shadow accompanied by high trading volume strengthens the signal, indicating strong buying or selling pressure. Risk Management and Stop Loss

While long shadows can provide valuable insights, it's essential for traders to incorporate risk management strategies into their trading plans. Setting stoploss orders based on key support and resistance levels can help limit potential losses in case the market moves against the anticipated direction.

Conclusion

In conclusion, long shadows in stock trading represent significant price movements within a trading period and offer valuable insights into market sentiment and potential reversals. By understanding and interpreting these shadows effectively, traders can make informed decisions and improve their trading performance. However, it's crucial to incorporate risk management strategies and validate signals with other technical indicators for successful trading outcomes.

免责声明:本网站部分内容由用户上传,若侵犯您权益,请联系我们,谢谢!联系QQ:2760375052